japan corporate tax rate kpmg

Beginning from 1 October 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their. The penalty is imposed at 5 to 10 once the tax audit notice is received.

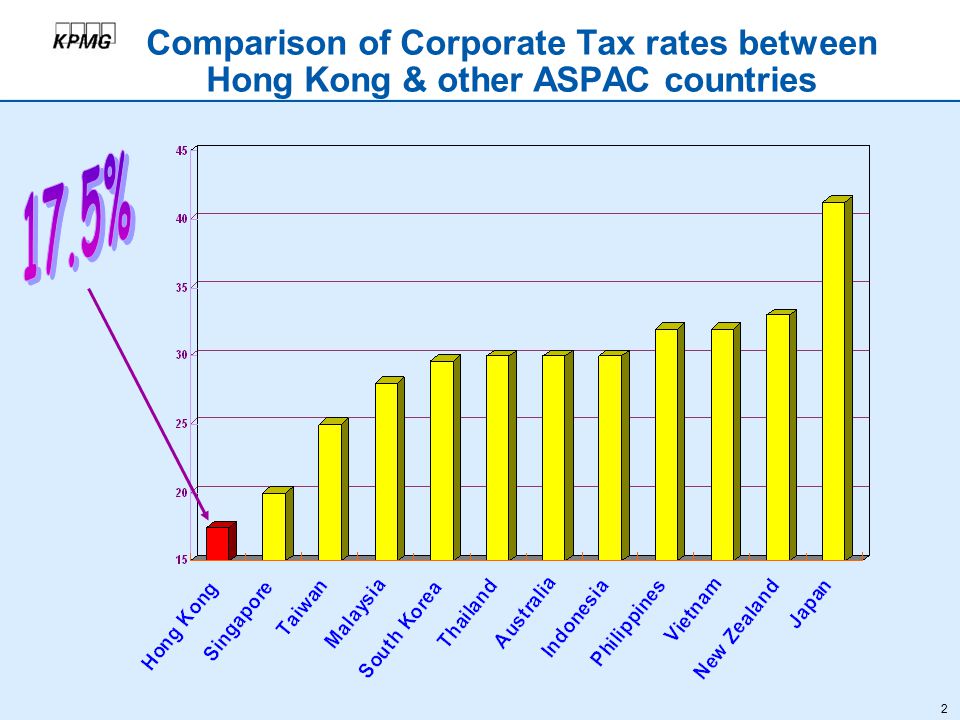

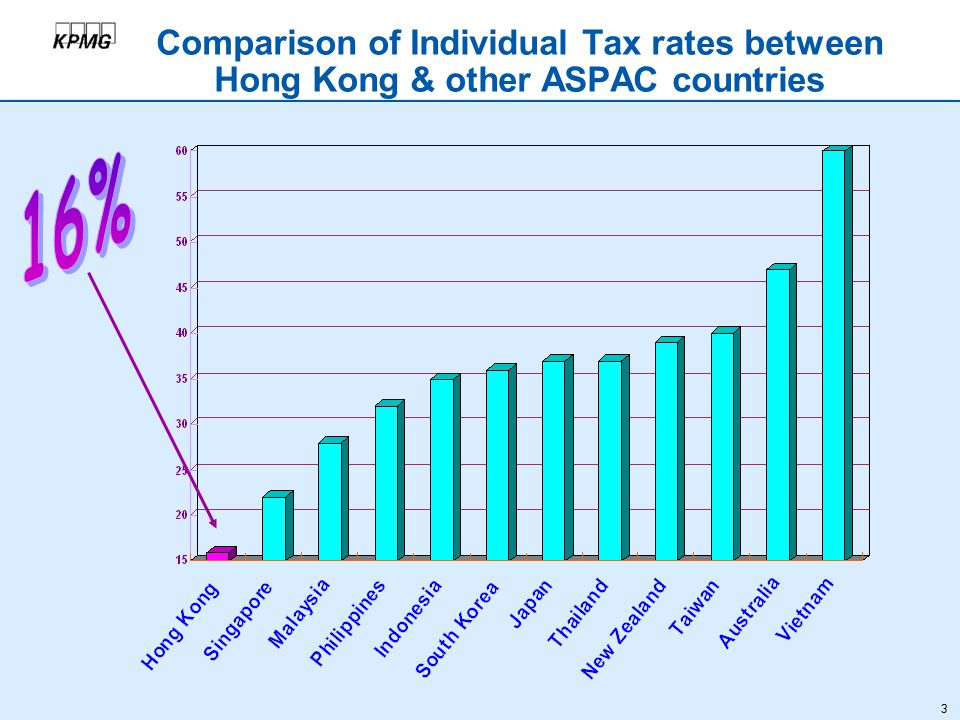

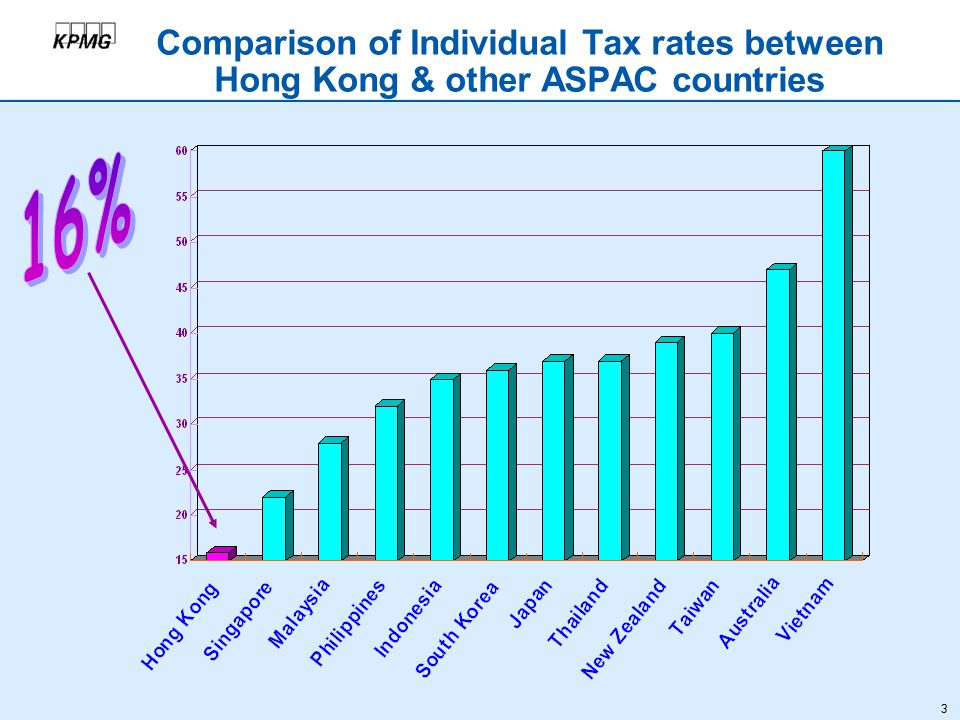

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

025 of capital plus capital surplus 25 of income x 14.

. I added value component tax rate. KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo. The current consumption tax rate is 10 percent increased from 8 percent on 1 October 2019.

22 to 28 depending on the companys shareholders structure corporate structure. Size-based business tax consists of two components. Principal International Tax KPMG US.

Summary of worldwide taxation of income and gains derived from listed securities from. 81 6 4708 5150 Fax. In addition interest for the late payment of tax is levied at 26 per annum for the first two.

Size-based business tax consists of two. Regular business tax rates currently apply and vary between 09 percent and 228 percent depending on the tax base taxable income and the location of the taxpayer. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP.

Kpmgs corporate tax rates table provides a view of corporate tax rates around the world. National local corporate tax. Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced.

KPMG Tax Corporation either through your normal contact at the firm or using the contact details shown below. This booklet is intended to provide a general overview of the taxation system in Japan. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34.

2021 Global Withholding Taxes. The special local corporate tax rate is 4142 and is imposed on taxable income multiplied by the standard regular business tax rate. Special local corporate tax rate is 674 percent which is imposed on taxable income multiplied by the standard of regular business tax rate.

Special local corporate tax rate is 935 percent which is imposed on taxable income multiplied by the standard of regular business tax rate. Corporate - Group taxation. Consumption tax value-added tax or VAT is levied when a business enterprise transfers goods provides services or imports goods into Japan.

The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer. From 072 percent to 0864 percent. Last reviewed - 02 March 2022.

Changes to the controlled foreign corporation CFC regime considering the corporate tax rate. The contents reflect the information available up to. Taxation in Japan Preface.

Corporate and international tax proposals in tax reform package 19 December 2018. Donation made to designated public purpose companies. The WHT for interest is applicable at a rate of 15 national tax and 5 local tax and a tax credit may be available for such WHT.

As with dividend income the WHT national. Improving Lives Through Smart Tax Policy. 81 6 4706 3881 Dainagoya Building 26F.

KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo. KPMG Tax Corporation either through your normal contact at the firm or using the contact details shown below. A reduced tax rate of 8 percent still applies to certain supplies see further.

Kpmg Corporate Tax Manager Kpmg Romania

Outline Of The 2021 Tax Reform Proposals Kpmg Japan

![]()

Canadian Personal Tax Tables Kpmg Canada

Tax Accounting 2020 Tax Rates And Other Changes Kpmg Canada

World S Highest Effective Personal Tax Rates

Net Zero Readiness Index Japan Kpmg Global

World S Highest Effective Personal Tax Rates

G20 Reiterates Support For Global Minimum Tax Kpmg Canada

Outline Of The 2022 Tax Reform Proposals Kpmg Japan

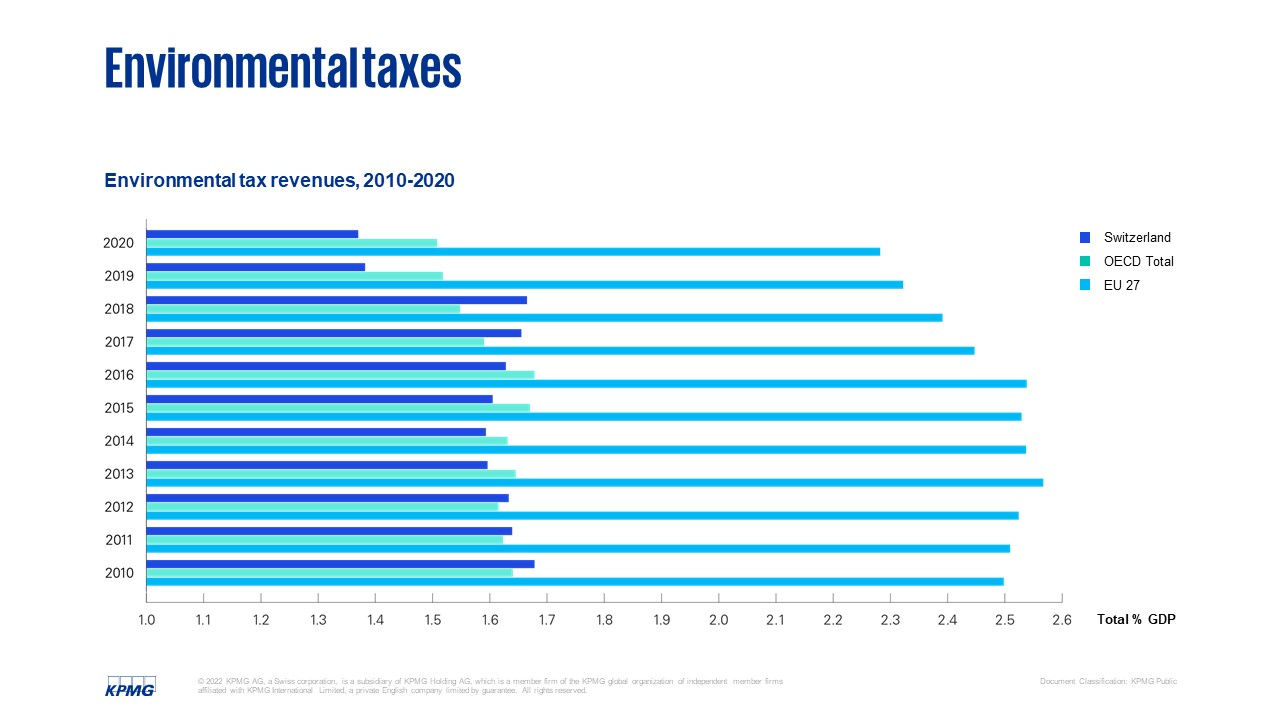

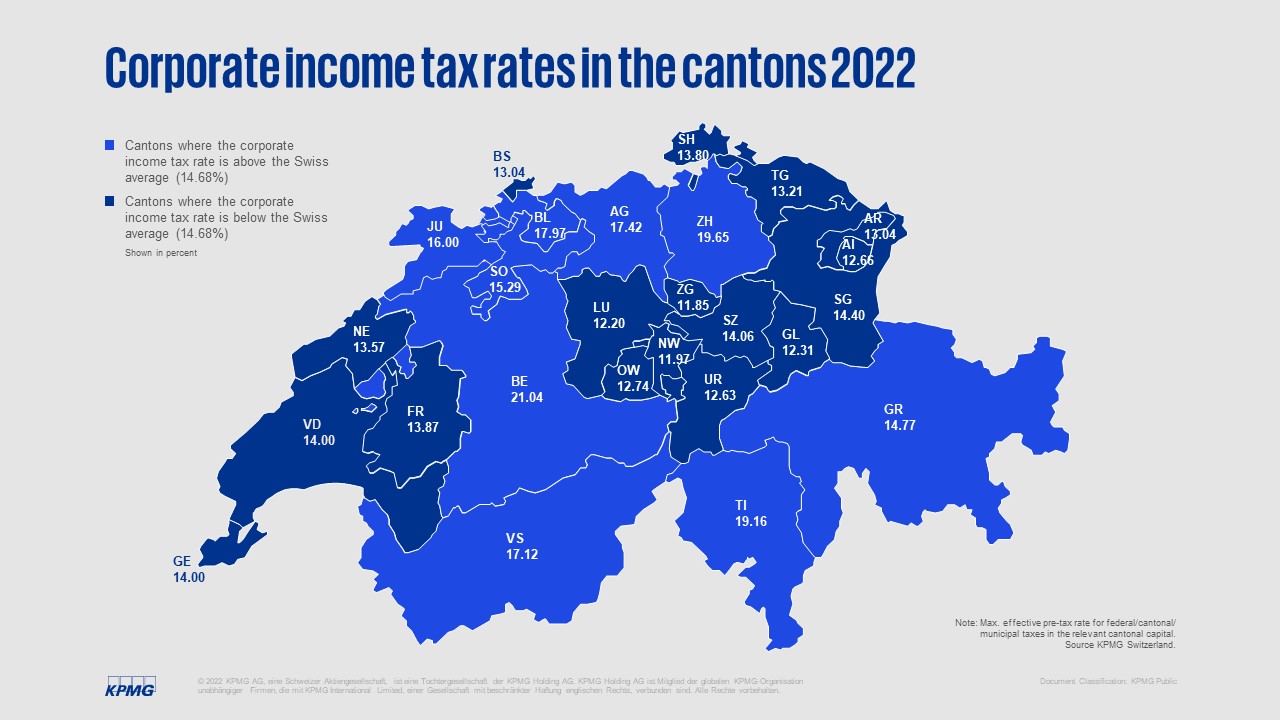

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

Cra Prescribed Rate Remains At 1 For Q3 2021 Kpmg Canada

Taxation In Japan 2019 Kpmg Japan

Net Zero Readiness Index Japan Kpmg Global

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

Corporate Tax Consulting Kpmg Canada

Canadian Personal Tax Tables Kpmg Canada