property tax forgiveness pa

Senior citizens should not get discouraged by high property tax rates since they can count on PA property tax relief. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Property Tax Penalty Forgiveness.

. Forgives some taxpayers of their liabilities even if they have not paid their Pennsylvania personal income tax. Resolve business and incomeWage Tax liens and judgments. Being a homeowner in Pennsylvania can qualify you for another property tax relief programthe state property tax reduction allocation.

Further to qualify for the credit it is necessary to calculate both the taxable. This section cited in 43 Pa. Get a property tax abatement.

To receive school property tax relief for tax years beginning July 1 or January 1 an application for homestead or farmstead exclusions must be filed by the preceding March 1. VIII 2c at 2-year intervals. Resolve bills or liens for work done by the City on a property.

Unmarried and Deceased Taxpayers. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. Appeal a property assessment.

The tax rate in the Pittsburgh area and Allegheny County is 201almost twice the national average. Code 524 relating to processing applications. Q6ppkgp Txxkim Provides a reduction in tax.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Ra-retxpagov Please do not send completed applications or personally identifiable information over e-mail. 2021 Real Property Taxes are Unaffected.

Use code enforcement numbers to request a payoff. If Line 13 is. A waiver of 50 of the total real property taxes and surcharges which have been outstanding for more than 180 days PROVIDED THAT full.

The State of Pennsylvania has a high average effective property tax rate of 150. Resolve water liens. Statewide property tax collections could reach nearly 20 billion in 2026-27 as revenues grow from 41 to 49 annually over the next five years according to a new IFO estimate.

To claim this credit it is necessary that a taxpayer file a PA-40 return and complete Schedule SP. It is not an automatic exemption or deduction. ELIGIBILITY INCOME TABLE 1.

Record the your PA tax liability from Line 12 of your PA-40. Property Tax Penalty Forgiveness. A The Commission will review cases that have been granted real property tax relief under the PA.

B On the second anniversary of the granting of real property tax relief under the PA. Subtract Line 13 from 12. Pay outstanding tax balances.

Any negotiated program will be effective after the local government officials have thoroughly reviewed the owners ability to pay and the request from the homeowners. In addition property tax rebates are increased by an additional 50 percent for senior households in the rest of the state so long as those households have incomes under 30000 and pay more than 15 percent of income in property taxes. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Properties owned by Non-Bahamians shall be entitled to a waiver of all surcharges payable on outstanding taxes which have been outstanding for more than 180 days provided that full payment of all sums is made on or before 31 May 2021. This places it among the top fifteen US. Taxes paid in December will now be assessed the penalty amount and those taxes must be paid by December 31 2020.

Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings bonds alimony the nontaxable gain on the sale of a home insurance proceeds inheritances winnings from the PA Lottery foster care payments and the value of gifts from people living outside the. Resolve judgements liens and debts. Code 524 relating to processing applications.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. However all property owners should take note of the following. Being a homeowner in Pennsylvania can qualify you for another property tax relief.

Provides a reduction in tax liability and. If none leave blank. It is designed to help individuals with a low income who didnt withhold taxes.

Then move across the row to find your eligibility income. To receive tax forgiveness a taxpayer must complete the tax forgiveness schedule and file a PA-40 return. Tax Forgiveness is determined based on marital status family size and eligibility income.

In Part D calculate the amount of your Tax Forgiveness. Counties in Pennsylvania collect an average of 135 of a propertys assesed fair market value as property tax per year. Some programs allow the creation of property tax installment plans for property owners who are delinquent in paying taxes as a result of saying being unemployed for the last several months.

In Part D calculate the amount of your Tax Forgiveness. Record tax paid to other states or countries. Property TaxRent Rebate Program claimants now have the option to submit program applications online with the Department of Revenues myPATH system.

Tax Forgiveness is determined based on marital status family size and eligibility income. Property TaxRent Rebate application assistance is available at no cost from Department of Revenue district offices local. Eligibility income for Tax Forgiveness is different from taxable income.

This is the first time in the history of the program that an electronic filing option is available for the Pennsylvanians who benefit from this program. The penalty for real estate taxes was forgiven through November 30 2020. Features myPATH offers for Property TaxRent Rebate claimants.

Cases that have been granted tax exemption will be reviewed every 5 years to determine continued need for exemption from certain real estate property taxes. School districts are required to notify homeowners by December 31 of each year if their property is not approved for the homestead or farmstead exclusion or if their approval is due to expire. If your Eligibility Income from PA Schedule SP Line 11 does not exceed.

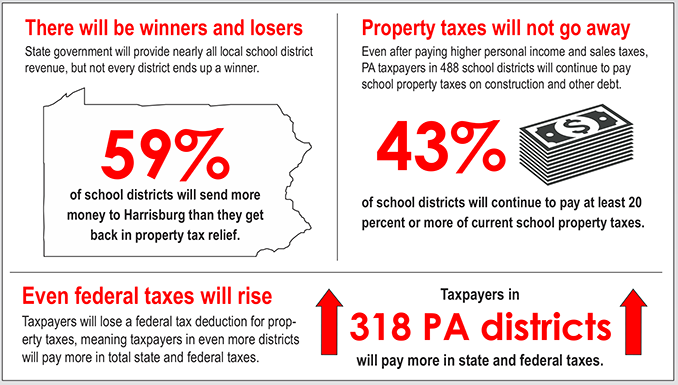

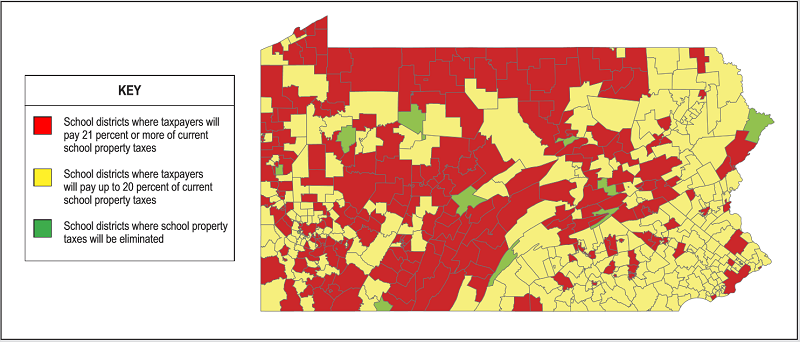

Property Tax Bill Will Cost Pa Taxpayers More

.jpg)

Pa State Rep Property Taxes Time To Eliminate

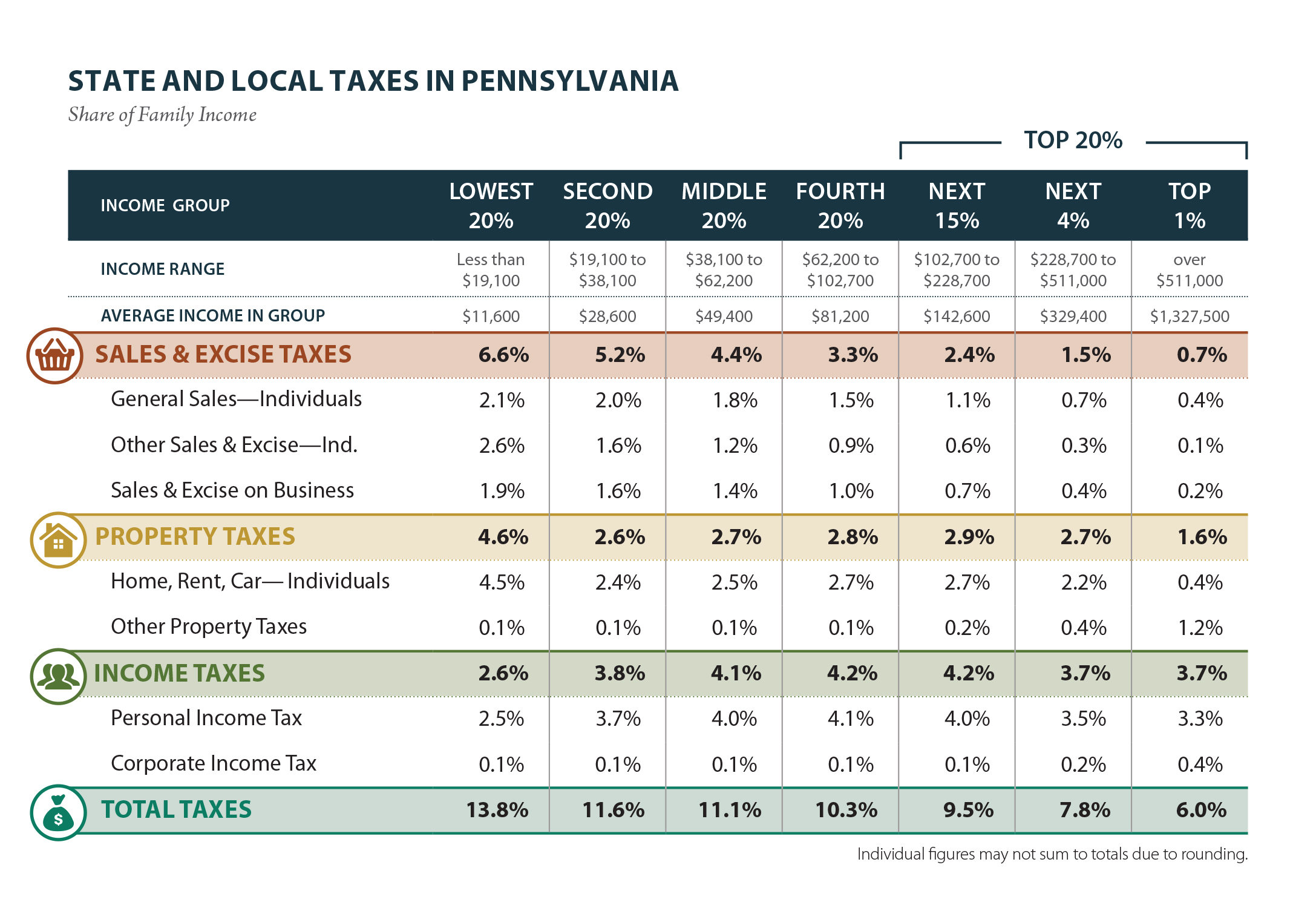

Pennsylvania Who Pays 6th Edition Itep

Pennsylvania Homestead Tax Relief The Commonwealth Of Pennsylvania S State Government Enacted Bullying Laws School Bullying Masters In Business Administration

So That S What It Takes To Get A Little Property Tax Relief Editorial Cartoon Pennsylvania Capital Star

Pennsylvania Budget Has New Tax Credits Rebates

State By State Guide To Taxes On Retirees Kiplinger

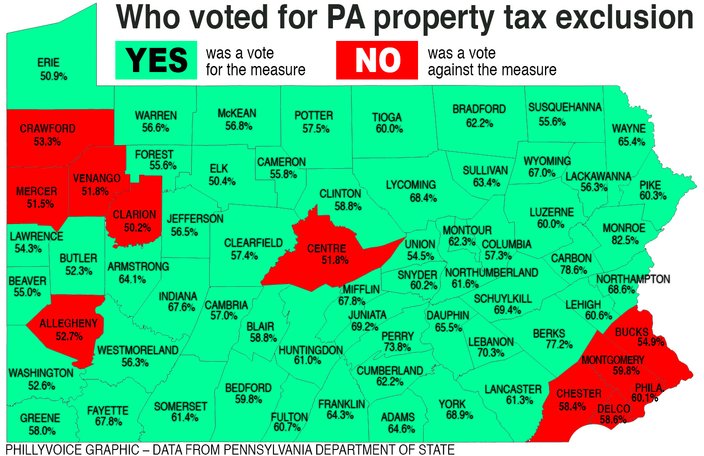

Map Here S Who Voted For Property Tax Exclusion In Pennsylvania Phillyvoice

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Visual Ly Chapter 13 Bankruptcy Bankruptcy Quotes

Property Tax Bill Will Cost Pa Taxpayers More

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Rates Today Mortgage Loan Originator

State By State Guide To Taxes On Retirees Kiplinger American History Timeline Retirement Advice Retirement Planning

.png)